In today’s digital age, mobile payments have become increasingly popular. Among the various mobile payment methods, Apple Pay stands out as a convenient and secure option. But did you know that you can maximize your rewards while using Apple Pay? In this step-by-step guide, we’ll walk you through the process of getting the most out of your Apple Pay experience.

Interesting articles:

Step 1: Introduction to Apple Pay Rewards

Before we delve into the details, it’s essential to understand why maximizing rewards with Apple Pay is a smart financial move. By earning rewards with your everyday transactions, you can make the most of your purchases and enjoy various benefits.

Apple Pay offers a seamless way to pay for your purchases using your iPhone or Apple Watch. It’s secure, convenient, and widely accepted at numerous retailers. So, why not leverage this payment method to boost your rewards?

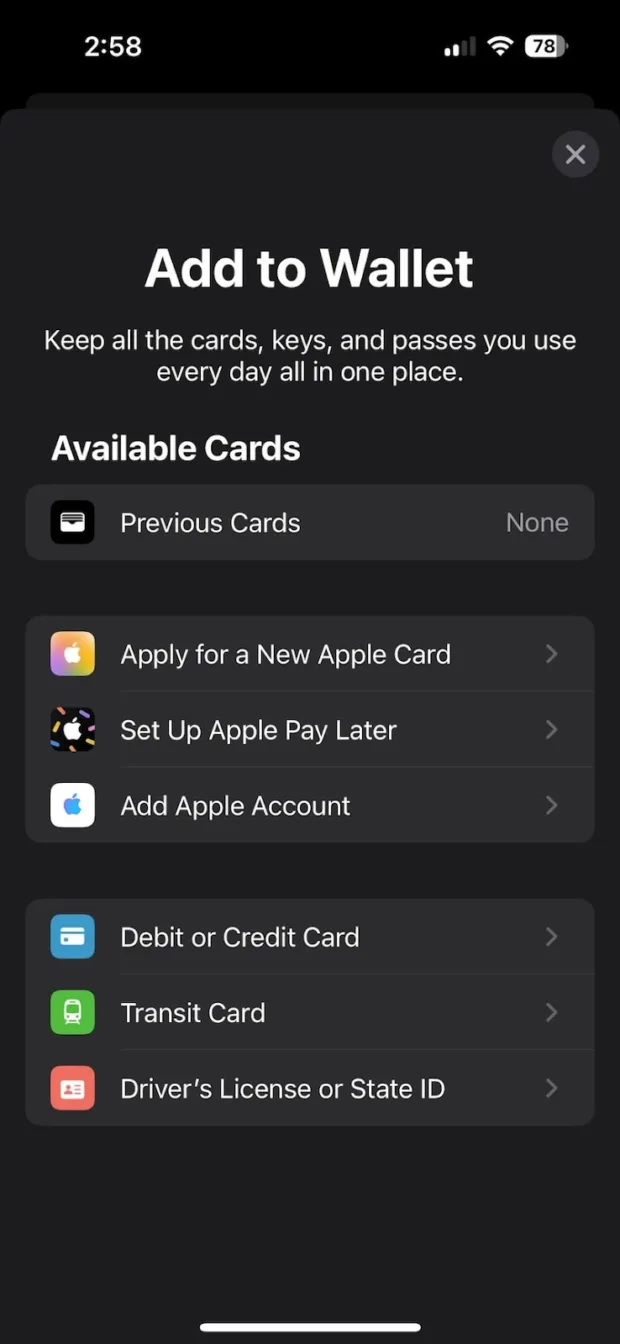

Step 2: Setting Up Apple Pay

To get started with maximizing your rewards, you’ll need to set up Apple Pay on your Apple device. Follow these simple steps:

- Open the Wallet app on your iPhone or Apple Watch.

- Tap on the “+” button to add a new card.

- Enter your card details or scan your card using the device’s camera.

- Verify your card with the issuing bank or card provider.

Once your card is verified, you’re ready to start using Apple Pay for contactless payments.

Step 3: Exploring Apple Pay Security

Security is a top priority when it comes to mobile payments. Apple Pay employs advanced security features, including encryption and tokenization, to safeguard your financial information. With these measures in place, your transactions are highly secure, and your sensitive data remains protected.

Step 4: Adding Rewards Cards

To maximize your rewards, you’ll want to add your reward-earning credit and debit cards to Apple Pay. This step ensures that you earn rewards with every purchase you make. Check with your card issuer to confirm that your cards are compatible with Apple Pay.

Step 5: Discovering Apple Pay-Compatible Retailers

Before you can earn rewards, you need to know where you can use Apple Pay. Fortunately, Apple Pay is widely accepted at various retailers, both online and in physical stores. To find out if a retailer accepts Apple Pay, look for the contactless payment symbol or the Apple Pay logo at the checkout counter. You can also check the Apple Pay website for a list of participating merchants.

Step 6: Earning Cash Back and Rewards

Now that you’ve set up Apple Pay and added your reward-earning cards, it’s time to start earning cash back and rewards. There are several ways to accumulate rewards with Apple Pay:

- Use your Apple Pay-linked cards for everyday purchases.

- Take advantage of special offers and promotions available through Apple Pay.

- Explore cashback opportunities offered by your card issuer.

Keep an eye on any specific terms and conditions related to earning rewards, and make sure to follow them to maximize your earnings.

Step 7: Redeeming Your Rewards

Once you’ve earned rewards, you have several options for redeeming them. The most common redemption methods include:

- Using your rewards for statement credits, reducing your outstanding card balance.

- Redeeming rewards for gift cards to popular retailers.

- Choosing direct deposits into your bank account.

Each redemption option has its advantages, so consider which one aligns best with your financial goals and spending habits. Additionally, keep an eye out for special promotions that may provide bonus rewards for specific redemption methods.

Step 8: Maximizing Rewards with Discover Cards

If you happen to have Discover cash back credit cards, you can take your rewards to the next level by combining them with Apple Pay. Discover offers an array of cash back cards, including the Discover It Cash Back, Discover It Chrome, and Discover It Miles cards, each tailored to different spending habits.

By using Discover cards with Apple Pay, you can earn cash back rewards on your purchases and potentially enjoy up to 10% cash back on select categories each quarter. This powerful combination allows you to supercharge your rewards and make the most of your spending.

Step 9: Quarterly Bonus Categories

Discover provides cardholders with a unique feature—quarterly bonus categories. These categories change every three months and offer an opportunity to earn higher cash back rewards on specific types of purchases.

To maximize your rewards, consider these strategies:

- Plan your purchases based on the upcoming bonus categories.

- Look for opportunities to stack rewards by combining Discover cards with retailer promotions.

- Use Apple Pay for your transactions, even at stores that don’t directly accept Discover.

Step 10: Additional Tips and Tricks

To wrap up, here are some additional tips and tricks to help you maximize your rewards with Apple Pay:

- Monitor your Discover account for special promotions and discounts.

- Take advantage of the first-year cash back match for new Discover cardholders.

- Compare redemption options to choose the most valuable one for your rewards.

In conclusion, you now have the knowledge and tools to make the most of Apple Pay and maximize your rewards. By following these steps and leveraging the power of Discover cards, you can enjoy the convenience of contactless payments while reaping the benefits of smart financial management.

Put your newfound knowledge into action by using Apple Pay for your everyday transactions. Start maximizing your rewards today, and watch your cash back and benefits grow. Your financial future is in your hands—make the most of it!